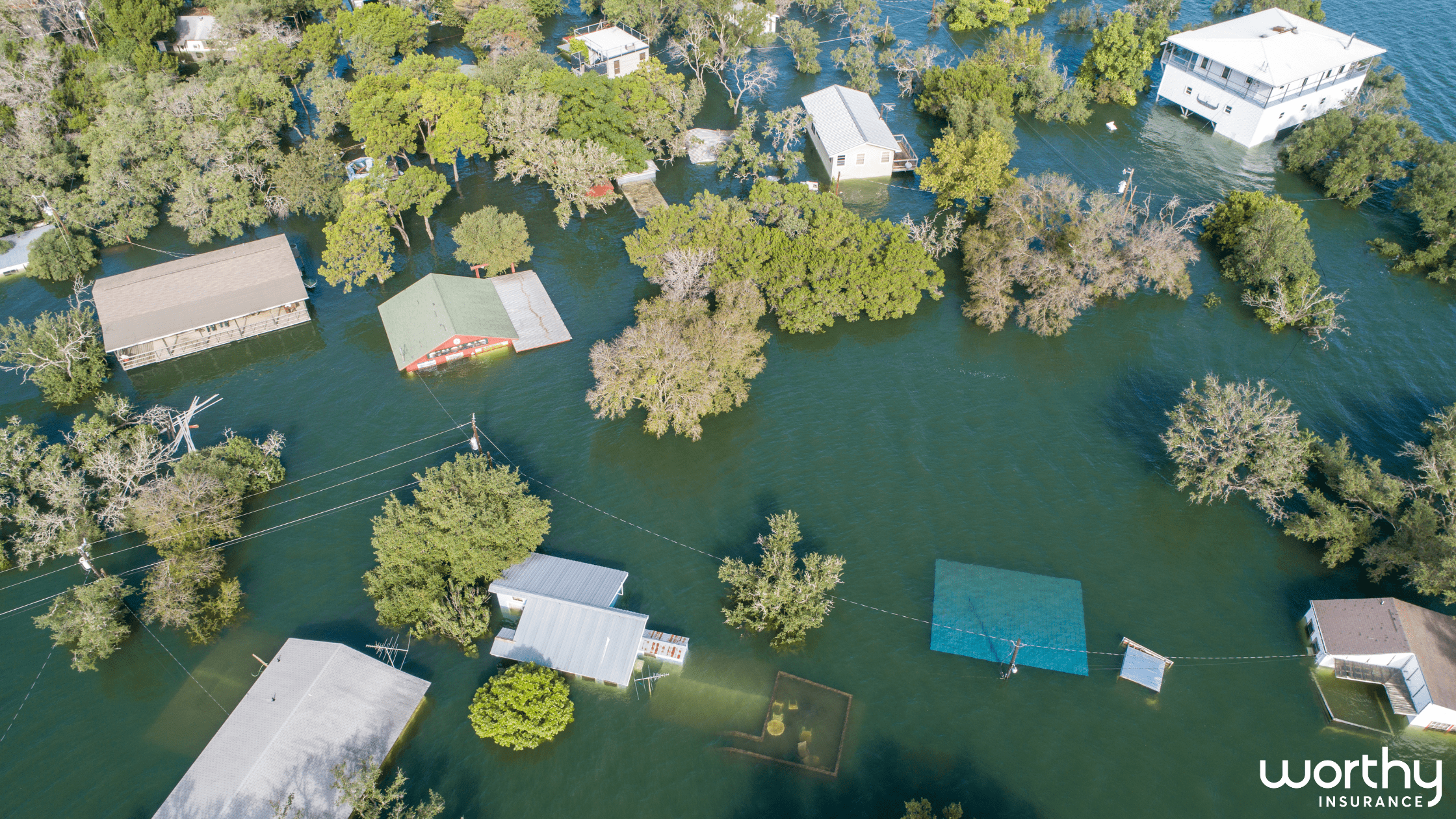

Flood insurance is a type of property insurance that helps protect homeowners and business owners from financial losses caused by flooding. Flooding can happen due to a variety of reasons, such as heavy rainfall, melting snow, coastal storms, or even broken dams or levees.

Flood insurance can help cover the cost of repairing or rebuilding your property if it is damaged or destroyed by a flood, as well as the cost of replacing any personal property that is lost or damaged. This can include things like furniture, appliances, and electronics. Some flood insurance policies also provide additional living expenses coverage, which can help cover the cost of temporary housing if you are unable to live in your home or business due to flood damage.

It’s important to note that standard homeowners’ insurance policies do not typically cover flood damage. So, if you live in an area that is prone to flooding, or if you are a business owner with property in such an area, it’s a good idea to consider purchasing flood insurance.

Another important factor to note is that flood insurance is available through the National Flood Insurance Program (NFIP), which is administered by the Federal Emergency Management Agency (FEMA). If you live in a community that participates in the NFIP, you may be eligible to purchase a policy through this program.

Overall Flood coverage is integral for homeowners and business owners, especially those living in an area that is prone to flooding, because it can help protect them from financial losses caused by flood damage, which can be costly and disruptive. It’s also important to note that if you have a mortgage on a property located in a flood zone, your lender will typically require you to have flood insurance as a condition of your loan.

Here are a few statistics that highlight that importance of adding flood insurance coverage:

-

According to the Federal Emergency Management Agency (FEMA), floods are the most common and costly natural disaster in the United States.

-

The National Flood Insurance Program (NFIP) reports that, on average, the cost of a flood claim is around $50,000.

-

In the past 10 years, the average number of flood claims per year is over 200,000.

-

A study by the National Oceanic and Atmospheric Administration (NOAA) found that, in the United States, flash flooding causes more deaths each year than any other weather-related hazard.

-

The Insurance Information Institute (III) reports that, in 2019, total insured losses from flooding in the United States were over $8 billion.

These statistics demonstrate that floods can cause significant financial losses, and that having adequate flood insurance coverage is important in protecting your property, assets, and personal finances in the event of a flood. Even if you live in a low-risk area, it is still worth considering flood insurance as it’s difficult to predict when and where floods will occur and it can happen to anyone.

It’s also worth noting that many people in the US mistakenly believe that they are covered by the federal government in the event of a flood, through the national flood insurance program (NFIP), but it’s not the case, it’s just an option available and not mandatory. As an important part of your overall insurance coverage, it’s always a good idea to speak with an insurance professional and understand your options for flood insurance and ensure that you have adequate coverage for your needs.

Contact

Interested in learning more about Worthy Insurance? Please email us at hello@worthyinsurance.com or call 773-945-9000.

Worthy Insurance is a niche broker with a focus on providing insurance placement and risk management services to the Healthcare, Manufacturing, Social Service, and Main Street business communities. Here at Worthy Insurance, we love to provide you with exciting and fun articles to learn more about insurance and how it impacts your life. Visit our other blogs to find more information.

While Worthy does offer a wide variety of insurance coverages, our main coverages include property coverage, worker’s compensation insurance, general liability, professional liability, and cybersecurity coverage. To find out the best coverages for your company, use the contact form below so you can be at ease knowing your company is covered. For personal insurance, please visit Vero Insurance.